Oh please ....cry me a fucking river ....boo hoo sob .....give up some of your bullshit .......what........ the wife has to give up starbucks........ and tennis........ and fitness instructor ......people live comfortblly on way way less ....this is horseshite .......well move then ....i mean FFS all these cunts today is complain ....give up some bullshit .....throw your kids out if they are old enough ....let them bastards work .....look what this fucker spends cash on ...he could downsize but no .......who gives a fuck ....people live better on less .....less is more .......

my family of four can no longer live comfortably on $230,000 a year — here’s how much the American Dream really costs

Searching for the American Dream? Be prepared to fork over nightmarish sums.

A former Goldman Sachs analyst says his family of four need to earn more than $230,000 per year in order to live comfortably in California’s San Francisco Bay Area.

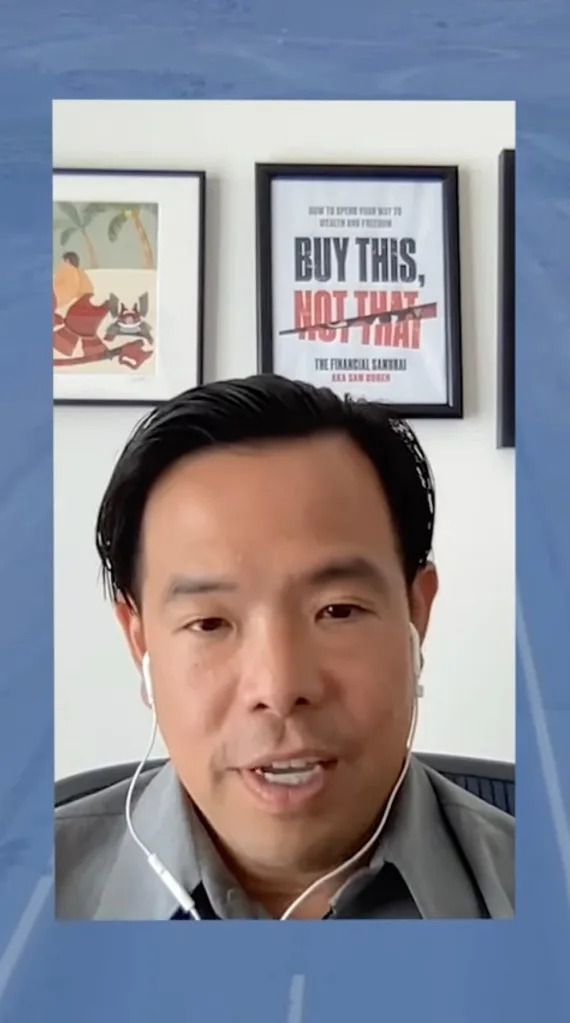

Sam Dogen, now 46, hit headlines in 2012 after retiring at the age of 34 with a $3 million net worth.

Since that time, the father-of-two — who has also penned the bestselling book “Buy This, Not That: How To Spend Your Way To Wealth And Freedom” — has been living off passive income from stocks, bonds, and real estate.

But in a candid new post for his website, Financial Samurai, Dogen revealed that he recently cashed out a considerable portion of his investments to purchase a property for his young family, in struggling but still pricey San Francisco.

Now, the financial guru says his investments will generate just $230,000 before tax, while his annual expenses are projected to top $288,000 in 2024. To net that sum, Dogen estimated he would have to earn approximately $420,000 a year before taxes were taken out.

Dogen declared that he was “not asking for sympathy or empathy,” freely admitting that he lives a solidly upper-middle-class life with his wife and two children.

However, he broke down his estimated annual expenses, saying they would be comparable to those of other two-parent, two-children families living in similarly expensive locales, including New York City.

“The budget is based off my ideal lifestyle for a family of four in a big city,” he wrote. “Of course, there are areas to cut. But overall, it is a realistic and comfortable lifestyle.”

Dogen’s annual budget includes $80,400 for private grade school tuition for his two kids, as well as $24,000 for healthcare costs.

He estimates food expenses will top $26,000 this year, while housing expenses, including property taxes, maintenance and insurances, are estimated at a whopping $68,400.

Because both my wife and I don’t have day jobs, we have to pay for unsubsidized healthcare insurance ourselves, which cost $2300 a month in premiums,” Dogen explained.

As for San Francisco’s wildly expensive real estate prices, the finance guru stated: “The good thing about living in San Francisco is that there are so many career and money-making opportunities… There’s just too much excitement to leave to a lower cost area of the country to try to save money at the moment.”

Dogen’s budget breakdown is sure to alarm the growing group of Americans who are struggling to cope with soaring costs of utilities, rent, and groceries.

“It really is a struggle to raise a family in an expensive city, save for retirement, figure out how to spend a lot of time with your kids before they leave for college, and enjoy life in general,” Dogen told The Post.

The former analyst, who holds an MBA from the University of California, Berkeley and also worked as an executive director at Credit Suisse, says he is now looking at going back to work or consulting after more than a decade of retirement.

According to Forbes, the average annual salary for a working American currently stands at $59,428. In Dogen’s California, the sum is slightly higher, at $73,220.

Meanwhile, a recent recent study conducted by Investopedia found that the average US citizen needs to make a whopping $3,455,305 throughout their lifetime to live the American Dream — which was classified as “owning a home, a car, a pet and sending two children to school.”

However, the average American — across all education levels — only rakes in roughly $2.3 million, according to the research.

Despite ongoing inflation, Dogen’s top financial tip is to try and save wherever possible and invest wisely.

“The best way to combat inflation is to save aggressively and invest consistently,” he said. History has shown that risk assets like real estate and stocks tend to outperform inflation overtime. Therefore, it behooves everybody to save and invest as much as possible for as long as possible.”

No comments:

Post a Comment